Bullish Calendar Spread. If roku rises to $90 before the. A calendar spread is an options strategy that involves multiple legs.

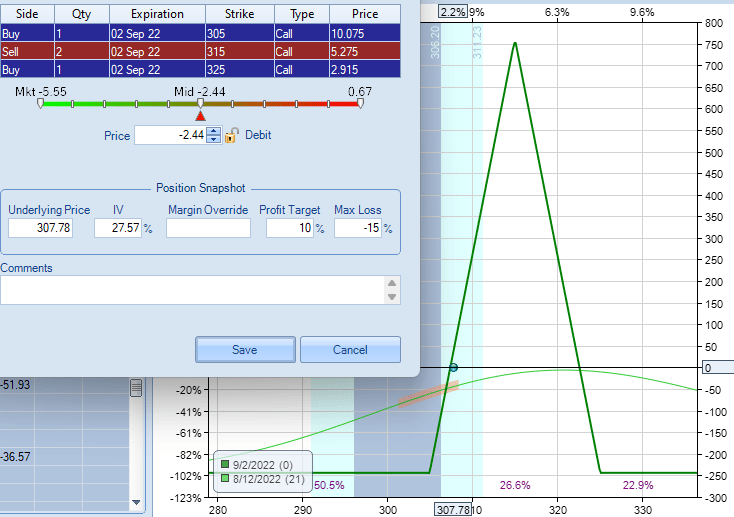

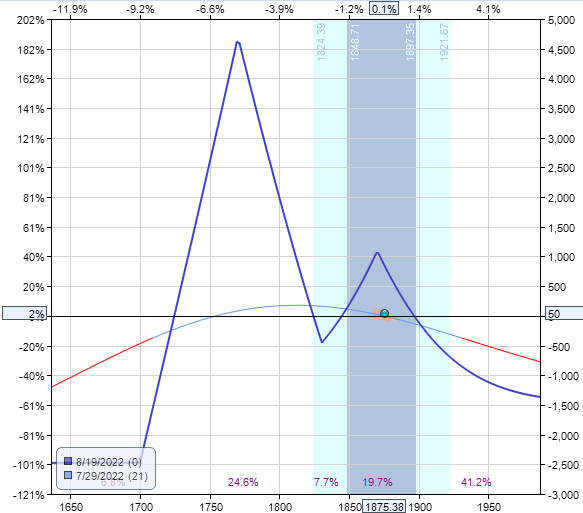

Td ameritrade can help us analyse the profitability of this calendar spread. This lly calendar call spread could turn 255% profit.

bullish calendar spread Options Trading IQ, Here are a few examples of calendar spread trades: What is a reverse calendar spread?

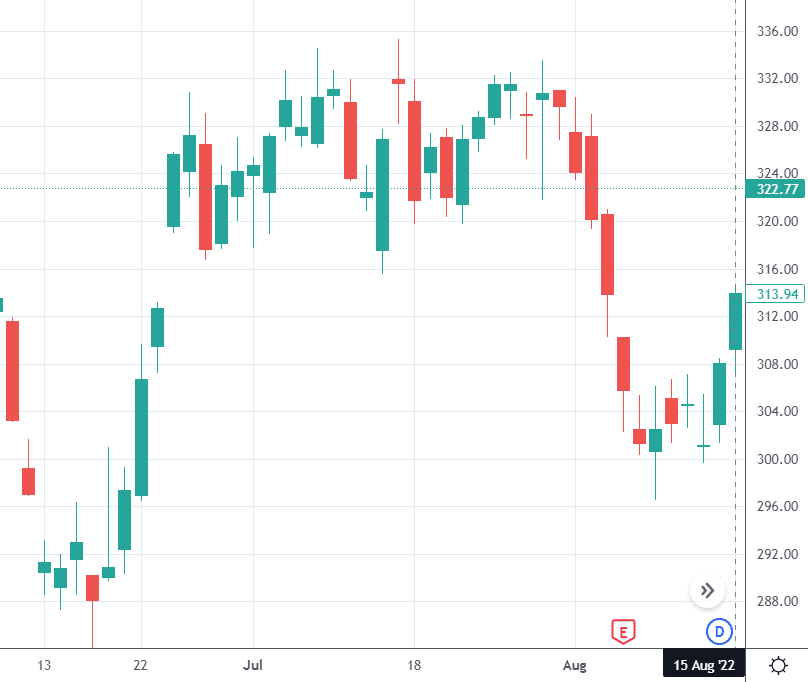

Bullish Vs Bearish how to tell if a market is bear or bullish, Roku bullish calendar spread setup. A calendar spread is a trading technique that takes both long and short positions with various delivery dates on the same underlying asset.

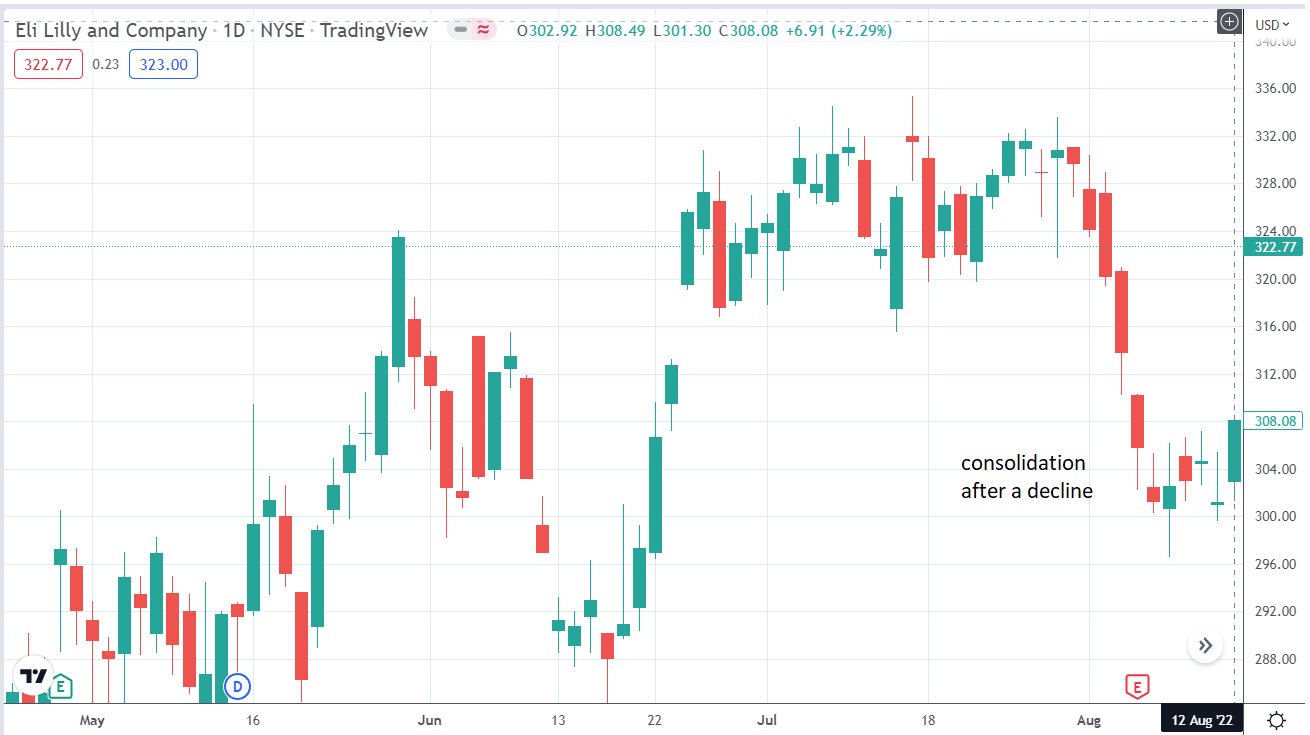

The Bullish Calendar Spread, This lly calendar call spread could turn 255% profit. Bull spreads come in two.

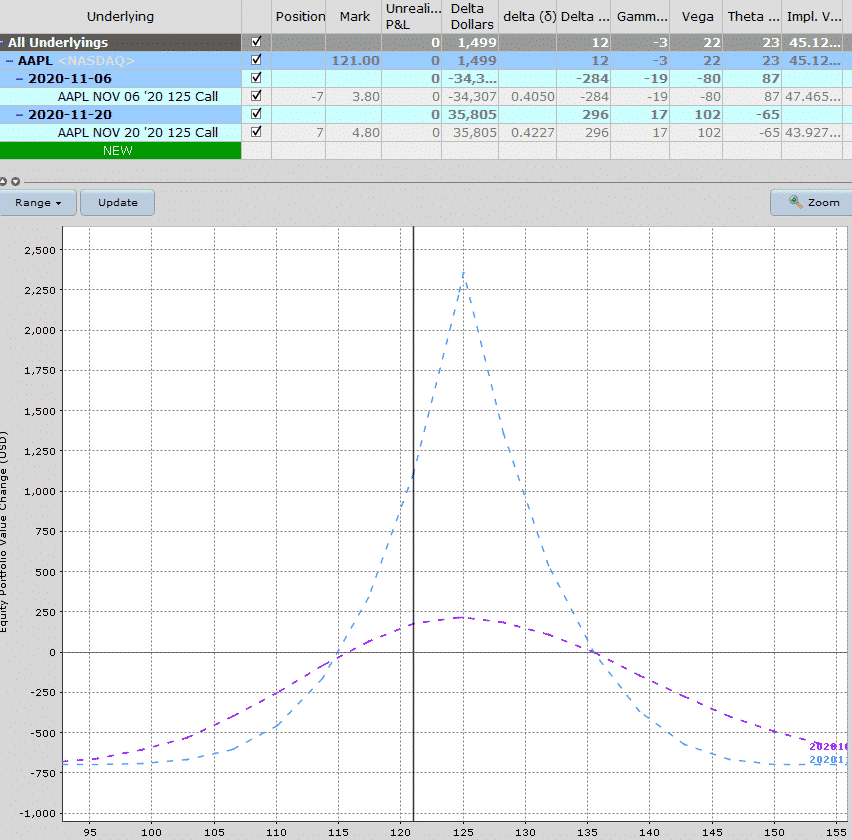

Trade Review AAPL Bullish Calendar / Double Calendar Spread, It can be used by itself as a directional trade. The aapl calendar call spread we've identified here can be a good way to play a bullish outlook because the option strategy has a +332% upside potential, is 18%.

The Bullish Calendar Spread, Assume that an investor is bullish on a stock and expects its price to. For financial advisers, their bullish enthusiasm hasn’t declined at all, eassye said.

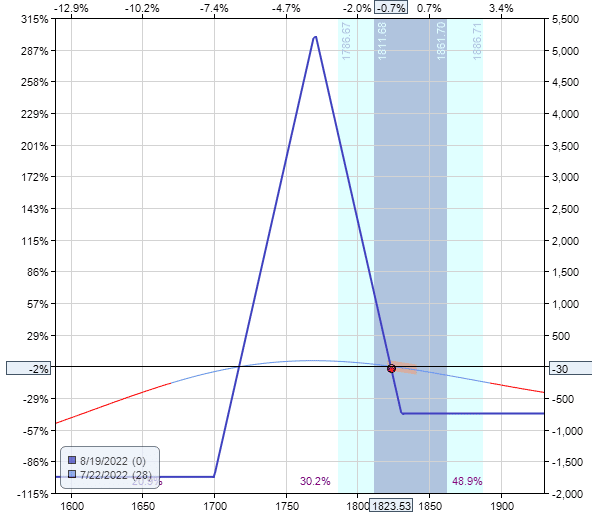

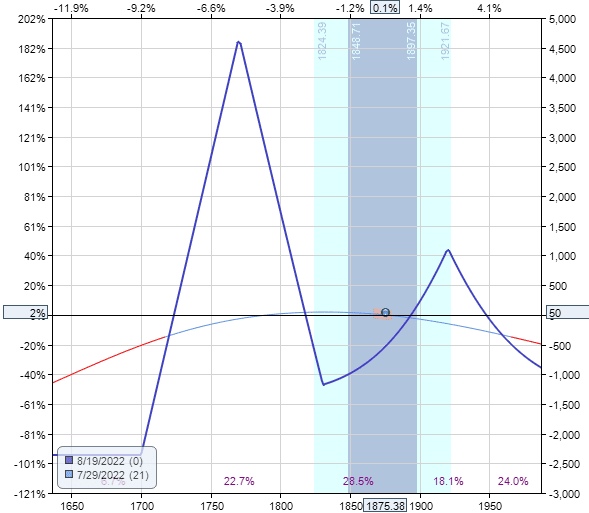

The Bullish Calendar Spread, 29 january 2025, 10:01 am. The mu calendar call spread we've identified here can be a good way to play a bullish outlook because the option strategy has a +413% upside potential, is 24%.

The Bullish Calendar Spread, Roku bullish calendar spread setup. A bull spread is an optimistic options strategy used when the investor expects a moderate rise in the price of the underlying asset.

Options Trading Strategies Bullish Bull Calendar Spread, Here are a few examples of calendar spread trades: What is a calendar spread?

Call Calendar Spread Option Alpha, This spy calendar call spread targets 358% return. Assume that an investor is bullish on a stock and expects its price to.

Yes, a calendar spread strategy can be applied to neutral, bullish, or bearish market trends by adjusting the strike prices and contract types accordingly.